Stamp Duty explained

Things seem to be always changing with Stamp Duty so we thought it would be a good idea to jot down the key points you need to know, as a helpful guide for our bunnyhomes buyers.

what is Stamp Duty?

First of all, what is Stamp Duty? It’s a land tax charged to you, the home buyer, by the Government when you buy a home, whether it’s brand new or pre-owned. Sometimes you’ll see it called SDLT (Stamp Duty Land Tax).

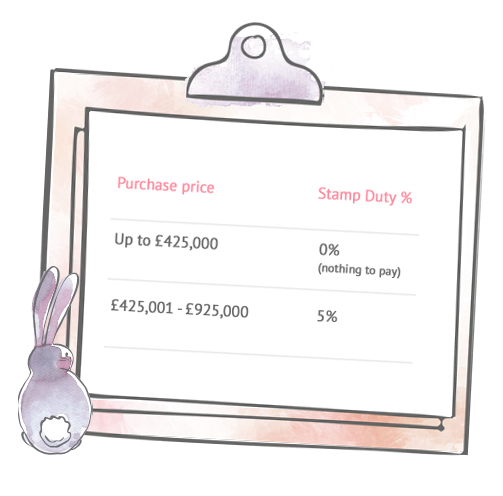

first-time buyers

If you’re a first-time buyer one of the recent changes by the Government is brilliant news for you — allowing you to buy a home up to £425,000 without having to pay a penny in Stamp Duty!

So if you’re looking to buy a bunnyhome for £425,000 it now means you’ll pay nothing whatsoever in Stamp Duty — zero, zilch, nada. How good is that? And if you buy a home that’s more than that you’ll only have to pay Stamp Duty on the amount over £425,000.

The value of a property for which first time buyers can claim relief has also gone up — from £500,000 to £625,000 (Stamp Duty is then payable at 5% on the portion £425,001 — £625,000).

It’s just one of the steps the Government has taken to make that first hop onto the ladder that little bit easier for those just starting out on their journey of home ownership.

everyone else

For everyone else, the residential nil-rate Stamp Duty threshold has doubled from £125,000 to £250,000, with the % rates applied in bands that go up with the purchase price. The figures vary a bit in Scotland and Wales, but here’s how it works in England, where we currently build all our bunnyhomes.

Charges are applied in portions, not to the whole amount. Confused? For example, if you’re buying a new home for £650,000 and you’re not a first-time buyer, you won’t pay anything on the first £250,000, you’ll only pay 5% on the amount between £250,001 and £650,000, which works out to £20,000, effectively circa 3% overall.

Don’t worry about doing the maths — just use the Government’s Stamp Duty calculator.

great news...

the new Stamp Duty measures apply to all home purchases from 23rd September 2022.

Stamp Duty on 2nd homes

If you’re thinking of buying a 2nd home or buying to rent out (buy to let), sadly you’ll have to pay more in Stamp Duty, usually an extra 3% on top of the standard rates.

who and how to pay

Stamp Duty is payable to the Tax Office — HMRC (Her Majesty’s Revenue & Customs) but don’t worry, this is usually all taken care of for you by your solicitor or conveyancer as part of your house purchase. On paying the Stamp Duty on your behalf, (within 14 days after completion) they’ll receive a certificate, which they need so they can legally register the change of ownership with the Land Registry office.

That’s all you really need to know about Stamp Duty, but if any of that has left questions unanswered the bunnyhomes team are just at the end of a phone line or email if you need to chat. Or you can pin down your solicitor for more info, or check out HMRC’s own website.